Why Choose Valley First Credit Union?

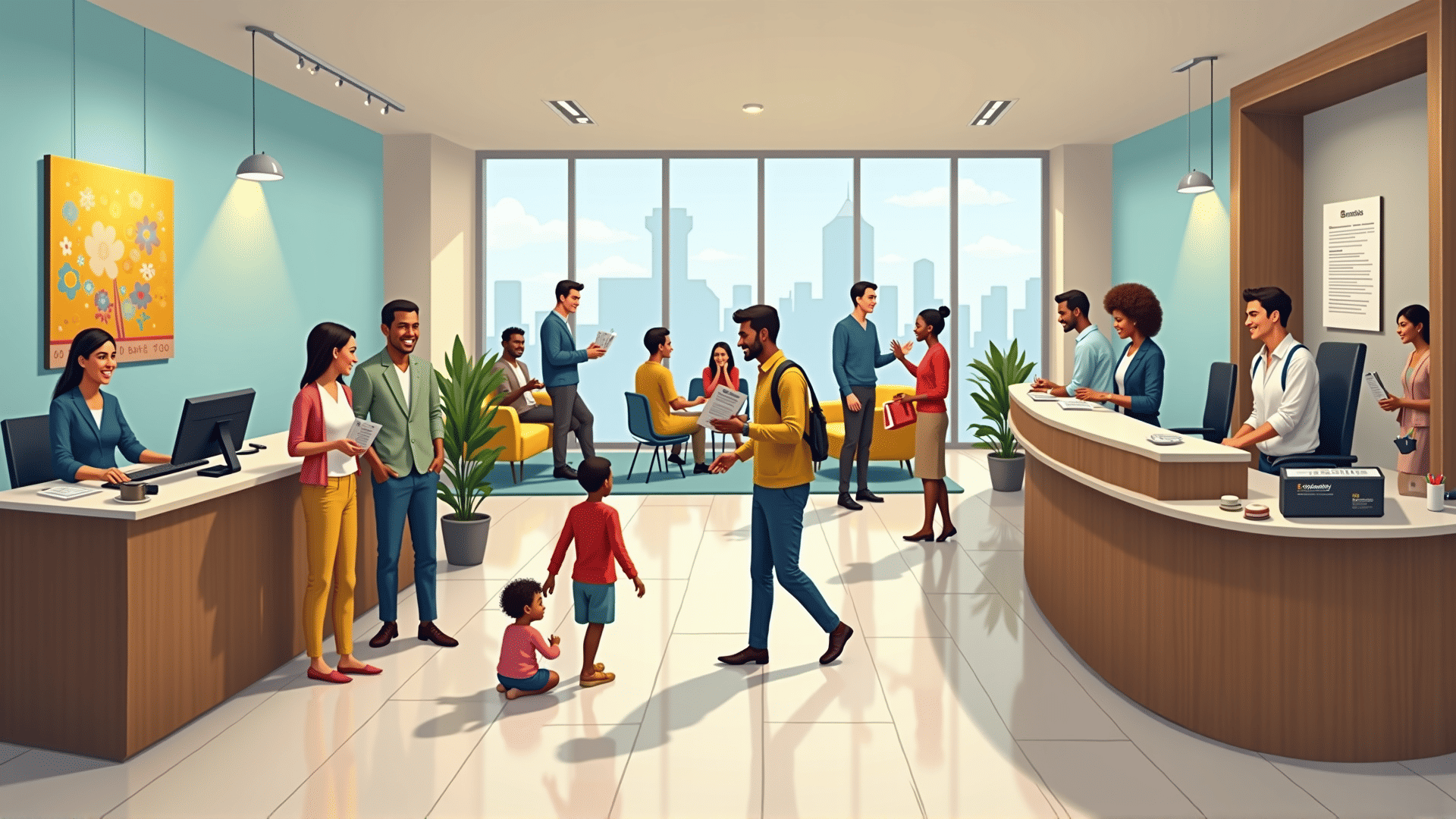

Experience Banking Like Never Before

At Valley First Credit Union, we focus on your financial well-being. Our array of services is tailored to accommodate your personal and business needs, ensuring ease and security. Established in the core of the community, we are committed to making banking simple and beneficial.

20K+

Reliability You Can Trust

15

Community Focus

3K+

Innovative Solutions

98%

Customer-Centric Approach